Back in 2021, we decided to pull the pin and apply for the NAB Equity Builder product. Within just a few weeks we were approved for a $30,000 facility and transferred $10k of cash and VDHG into our account to bring our VDHG holding up to $40,000. Since then, a lot has happened, so this post summarises our experience.

Starting out with NAB Equity Builder

We applied with pretty awesome starting incomes; $180,000+$80,000 between us, and a solid $30k of shares already held in our CommSec account, of which, $10k was VDHG. Unfortunately, we had (and still have) some existing debts which limited our borrowing power to just $30,000 which was well below our expected amount. Alas, we pushed on, submitted our application and documents, and setup our account pretty quickly.

One of the first things you’ll notice about the Equity Builder application process, is that EVERYTHING is manual. There’s no buy/sell function like your typical exchange… Everything is paper based; that is, there’s a PDF file with every form imaginable available, and you have to print out and fill it in, scan it and send back. No, they aren’t even fillable PDF forms… This is a bit of a frustration but not one you’ll need to do regularly.

Transferring Stocks to NAB Equity Builder

This was one of our first paper forms after the application…The process was pretty straight forward, grabbing your HIN from a recent CHESS holding statement or from your broker account, and sending through some basic details. This was completely within a week of submitting the forms.

Easy? 100%. Could it be better? Refer un-editable PDF forms.

Paying down your NAB Equity Builder facility

From the get go, you need to link your facility to a bank account which you can direct debit a monthly payment from. There doesn’t appear to be any option to change the date, and we get debited on the 1st of the month (or thereabouts). Another pain point with our irregular paycycles, but one we’ve grown accustomed to.

On top of our standard repayments, we also opted to add extra repayments; this can be done by transferring from your bank to the NAB facility’s BSB/account numbers which are listed on the Equity Lending portal for your facility.

Further to repayments, your dividends default to paying out cash into your NAB Equity Builder account to pay down your balance. We have changed this a few times to utilise the VDHG dividend reinvestment plan and changed back again to cash; we ended up doing some modelling around long term growth and found that utilising an accelerated repayment plan in addition to cash payments, we could repay our facility on a yearly basis to effortlessly grow our portfolio at a huge rate.

Using your facility to purchase more shares

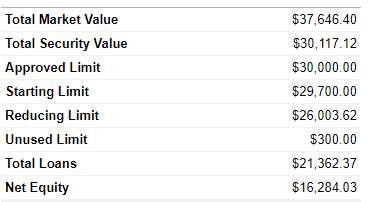

Something which was not very clear to us and I confirmed with our NAB account manager in the last week is that after paying down your facility, you can use the ‘credit’ to purchase new shares. This is made confusing by NAB’s portal, as it shows some basic balances, and shows ‘unused limit’ and some more interesting terms such as ‘security value’ and ‘reducing limit’.

Reducing limit is what your loan balance SHOULD be if you stuck to your normal payments; so in our case, this doesn’t reflect extra payments made, and so is higher than the actual balance.

Total Security Value eludes us….

The total loans figure shows that we have approximately $8600 paid off the facility, and this, as I noted above confirming with our account manager, can be used to purchase additional shares.

Increasing your loan limit

This is where things get interesting. After 18 months, we submitted yet another paper form to increase our limit, this time hoping to bump it up a little higher after some massive salary growth in that time between the both of us to $230k+ and 120k+. We’d also cut up some credit cards and consolidated our loans, reducing our outgoings significantly. However; having ~$5k in extra cash flow per month didn’t seem to get us far with NAB who emphasised that debt and assets are our shortfall; fair enough. A mediocre bump up to $40k was instead approved the day we submitted the form, and we were able to submit another form to then increase our VDHG holdings by purchasing another $20k worth.

What do we think of NAB Equity Builder after 18 months?

It’s a solid tool in our portfolio and we’d definitely do this all over again. We opted not to use a financial advisor in setting up our facility, so this might be something I would change if I were to do this all over, due to the administration of paper forms etc.

With interest rates now at 6.5%, up from the 3.5% when we first joined, our repayments have increased by a small $30 per month, which hasn’t really impacted our plans.

Further to this, we were able to claim interest on our tax return the last few years which didn’t amount to a great deal, but offset some of the tax on earnings we made in VDHG.

Interestingly, with the higher interest rates, we expect that our VDHG returns over the next year may shrink and we’ll pay more in interest than what we gain in dividend payments, which is something you may want to consider. From our perspective, this means we claim a larger interest cost to purchase the shares on our tax return, however we may also opt to make additional payments simply to limit our interest paid.

Regardless, being in the market and earning cash and growing our portfolio balance is far more important than a few bucks on our tax return at this stage. I think the NAB product does a great job of enabling this and we’re hoping to expand our holding from our current $50k to over $100k in the next year with some accelerated repayments. As noted above, we did some modelling around our repayments to maximise our growth and found that we could pay off our facility every year by committing all of our leftover pay and dividend payments to the facility. By modelling expected facility increases also, we should be able to grow the portfolio to a massive $3.5million over 20 years. In fact, by 2032, we expect to earn over $100k per year in dividend payments, which will see us hitting our financial independence numbers in our mid 40’s.

If you have any questions about the NAB facility and how we use it, post your comments below and we’ll get back to you!